Bookkeeping

Common Collection Interval

Lastly, technology plays an growing position; the utilization of accounting systems can improve debt invoice management and improve the general collection course of. Studying how to https://www.kelleysbookkeeping.com/ calculate common collection period will help your accounts receivables staff to find the place they stand and take motion to shorten their score. The best average assortment interval is about balancing between your business’s credit phrases and your accounts receivables.

Firm Credit Coverage

Navigating the financial panorama of a enterprise includes understanding various metrics, and one such crucial side is the average assortment interval. If your aim is to collect inside 30 days, then a mean assortment period of 27.38 would sign efficiency. If your average assortment interval was considerably longer than your target assortment phrases, that’s indicative of a need to improve your collections efforts. There are many ways collection period you’ll be able to improve your processes, ranging from simple—such as using collections email templates—to more transformative—like investing in accounts receivable automation software program. The average collection period is the average variety of days it takes for a credit score sale to be collected.

Consider Credit Terms

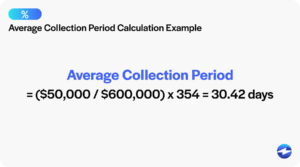

The earlier the supplier gets the funds, the better it is for business as a end result of this fund is a large supply of liquidity. The average assortment interval is the time an organization takes to transform its credit sales (accounts receivables) into money. It supplies liquidity to the corporate to meet its short-term needs or current expenses as and after they turn into due. When calculating the average assortment period, ensure the identical time-frame is getting used for both net credit score sales and common receivables. For example, if analyzing a company’s full-year revenue statement, the start and ending receivable balances pulled from the balance sheet should match the same interval. The average collection period is an accounting metric used to represent the common variety of days between a credit sale date and the date when the purchaser remits cost.

What’s Average Collection Period? A Key To Unlocking Company Cash Flow

- This would indicate extra efficient, streamlined cash flow and higher liquidity, giving a company confidence to make faster purchases and plan for larger bills.

- First, they’ll review and strengthen their credit policies, ensuring that credit terms are clear, cheap, and aligned with trade requirements.

- A shorter assortment interval interprets to quicker money influx, boosting liquidity.

- The accounts receivable (AR) turnover directly correlates to how long it’s going to take to collect on funds owed by prospects.

It could hint at deeper points, like clients experiencing monetary difficulties, which could danger your individual money move. In essence, this metric is a health examine for your corporation, flagging areas the place you might be vulnerable and the place streamlined processes might reinforce your monetary stability. First, the company’s credit policy performs a significant position; the more flexible the credit terms, the longer the time clients have to pay. Second, the industry during which the company operates affects the gathering interval, as cost behaviors differ across various sectors. Figuring Out the days sales outstanding ratio is a vital part of monetary management in any business, as it can significantly impact liquidity and the ability to satisfy financial obligations.

The Common Assortment Interval (ACP) is a monetary ratio that calculates the average number of days it takes for an organization to gather the money owed to it by its customers (its accounts receivable). In easier phrases, it’s the average time elapsed between when a sale is made on credit score and when the cash for that sale is actually acquired. A decrease common collection interval indicates that a company’s accounts receivable collections course of is fast, efficient, and environment friendly, leading to higher liquidity. It increases the cash inflow and proves the efficiency of company administration in managing its clients. An organization that can gather payments sooner or on time has robust collection practices and also has loyal clients.

A shorter collection interval translates to sooner money influx, boosting liquidity. On the opposite hand, an extended assortment period may tie up the company’s cash in accounts receivable, potentially jeopardizing its ability to satisfy short-term liabilities. On the opposite hand, a shorter assortment interval would possibly sign that the company maintains a strict credit score coverage, maybe due to prioritizing money flow stability.

Companies can assess their average assortment interval regarding the credit terms offered to clients. If the invoices are issued with a internet 30 due date, a collection period of 25 days won’t be a trigger for concern. Since it directly affects the company’s money flows, it’s crucial to monitor the excellent collection interval. Liquidity refers to the company’s capacity to meet its short-term obligations, and it is usually carefully tied to a company’s money flows.